Product Management in Banking: Driving Digital Transformation and Customer-Centric Solutions

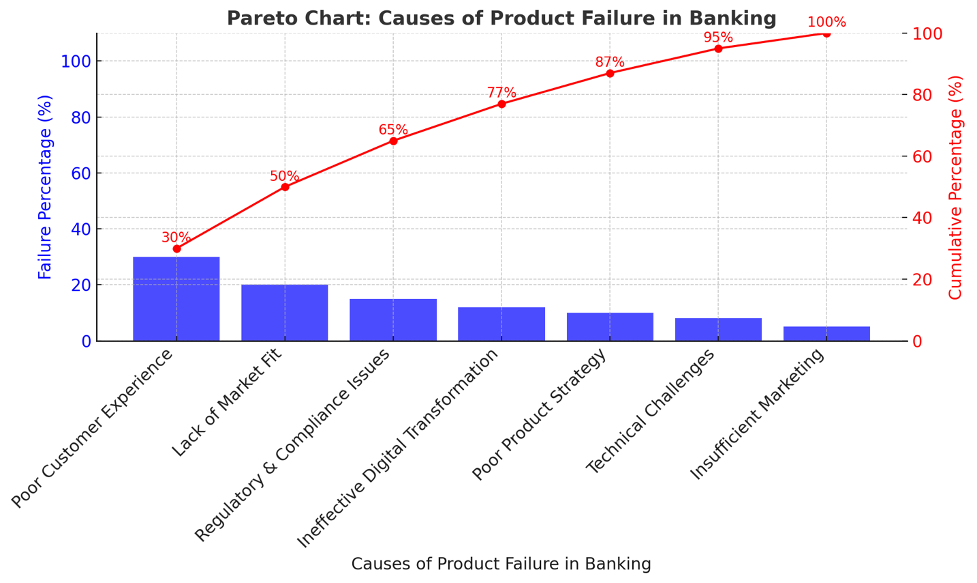

The banking industry is undergoing a rapid transformation, driven by digitalization, changing customer expectations, and increasing competition from fintech startups. However, success in digital banking is not guaranteed. Studies show that:

- 70% of all Digital Transformation projects do not reach their goals (Harvard Business Review, 2019).

- 47% of Agile Transformations fail (Scrum Submit, 2020).

- 80% of customers have switched brands due to poor customer experience (Qualtrics and ServiceNow, 2023).

These statistics highlight a critical challenge: banks must not only embrace digital and Agile practices but also execute them effectively with a strong product management mindset.

Why Product Management Matters in Banking

Traditional banking relied on long-established processes, with minimal focus on iterative product development. However, with the rise of digital banking, AI-driven financial solutions, and open banking APIs, banks must adopt Agile product management to remain competitive.

Key factors driving the need for robust product management in banking include:

- Changing Customer Expectations: Customers demand seamless, personalized, and digital-first banking experiences.

- Regulatory Changes: Compliance with data protection laws (e.g., GDPR, PSD2) requires banks to integrate security and transparency into product design.

- Competition from Fintech & Neobanks: Traditional banks must adopt customer-centric innovation to compete with digital-only banks and financial technology firms.

- Digital Transformation Challenges: Many banks struggle to integrate new technologies while maintaining legacy systems, contributing to the 70% failure rate in digital transformation projects.

The Role of a Product Manager in Banking

A banking product manager acts as a bridge between business goals, customer needs, and technology. Their responsibilities include:

- Defining Product Vision & Strategy

- Aligning banking products (loans, credit cards, mobile banking apps, etc.) with customer needs and market trends.

- Using data-driven insights to develop a product roadmap.

- Customer-Centric Approach

- Conducting market research and user interviews to understand pain points.

- Creating personas based on behavioral and psychographic segmentation.

- Cross-Functional Collaboration

- Working with development teams, compliance officers, marketing, and business units to ensure smooth product delivery.

- Communicating with stakeholders and managing expectations.

- Agile and Lean Product Development

- Implementing Minimum Marketable Releases (MMRs) and testing hypotheses before full-scale launches.

- Adopting Agile methodologies like Scrum and Kanban to iterate and improve products based on customer feedback.

- Avoiding common pitfalls, as 47% of Agile transformations fail, often due to poor execution and lack of cultural change.

- Risk Management & Compliance

- Ensuring banking products meet financial regulations and security standards.

- Managing technical debt while ensuring high-quality, scalable solutions.

Key Challenges in Banking Product Management

Despite its importance, product management in banking comes with unique challenges:

- Legacy Systems vs. Innovation: Banks must balance modern digital solutions with existing infrastructure.

- Regulatory Hurdles: Compliance can slow down product iterations and innovation.

- Security & Fraud Prevention: Financial products require robust cybersecurity measures.

- Customer Trust & Retention: With 80% of customers switching brands due to poor experiences, banks must prioritize seamless customer journeys and high-quality service.

Best Practices for Banking Product Management

To succeed, banking product managers should focus on:

✅ Customer-First Mindset: Build products based on real customer needs, not just business assumptions.

✅ Data-Driven Decision Making: Use AI, machine learning, and predictive analytics to understand trends.

✅ Agile & Iterative Development: Adopt small releases and continuous feedback loops while addressing the common reasons Agile transformations fail.

✅ Collaboration & Communication: Foster teamwork between business, IT, compliance, and customer support.

✅ Regulatory Awareness: Stay ahead of financial laws and ensure all products are compliant.

Conclusion

Product management in banking is no longer about just creating new accounts, loans, or financial services—it’s about designing seamless digital experiences that keep customers engaged and loyal. However, with high failure rates in digital and Agile transformations, banks must ensure they have the right product strategy, execution, and customer experience focus to avoid becoming part of the 70% of failed digital initiatives.